COMPANY NEWS

Essex Bio-Technology Announces 2020 Financial Results Sales of HK$654m & PAT of HK$170m recorded in 2nd Half

2021.03.12

Download

Sales of HK$654m & PAT of HK$170m recorded in 2nd Half Up from Sales of HK$324m & PAT of HK$49m recorded in 1st Half, a final dividend of HK$0.05 (2019: HK$0.05) per ordinary share declared

Hong Kong, 12 Mar 2021

Essex Bio-Technology Ltd (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the annual results for the year ended 31 December 2020.

2020 has been a challenging and unprecedented year, the impact from the outbreak of the novel coronavirus (“COVID-19”) was in ways we had never imagined. During the year under review, COVID-19 has negatively impacted our financial results and caused delay in ongoing clinical trial programmes. However, in these demanding times, leadership, team spirits and acting responsibly have become the most critical value to be resilient and allowed us to continue executing our plans.

Financial Performance

Hong Kong, 12 Mar 2021

Essex Bio-Technology Ltd (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the annual results for the year ended 31 December 2020.

2020 has been a challenging and unprecedented year, the impact from the outbreak of the novel coronavirus (“COVID-19”) was in ways we had never imagined. During the year under review, COVID-19 has negatively impacted our financial results and caused delay in ongoing clinical trial programmes. However, in these demanding times, leadership, team spirits and acting responsibly have become the most critical value to be resilient and allowed us to continue executing our plans.

Financial Performance

| (HK$m) | 2020 | 2019 | yoy | |

| Full year | Turnover | 978 | 1,279 | -23.6% |

| After-tax profit | 219 | 303 | -27.6% | |

| -1H | Turnover | 324 | 582 | -44.3% |

| After-tax profit | 49 | 130 | -62.0% | |

| -2H | Turnover | 654 | 698 | -6.2% |

| After-tax profit | 170 | 173 | -1.8% |

For the year ended 31 December 2020, Essex achieved a consolidated turnover of approximately HK$978.1 million, a decrease of 23.6% over the last year. The decrease is attributable to about 44.3% decrease in the first half of 2020 as the government implemented a series of control measures in a number of provinces and municipalities in the PRC to curb the spread of COVID-19, which had significantly disrupted the clinical operations of hospitals in the PRC and had prevented non-emergency patients visiting hospitals and outpatient clinics. However, as clinical operations of hospitals in the PRC have been largely resumed to normalcy in September 2020, the Group’s revenue has also been recovering to nearing the pre-COVID-19 level from the third quarter. The recovery had helped lower the decrease in revenue in the second half to approximately 6.2% as compared to the same period of last year.

The Group’s turnover is primarily made up from the segments of Ophthalmology and Surgical (Wound care and healing). The core products that are of current growth driver under each segment are:

1.Ophthalmology – Beifushu series (Beifushu eye drops, Beifushu eye gel and Beifushu unit-dose eye drops), Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Xa-latan® Eye Drops, Xalacom® Eye Drops and 适丽顺® (Iodized Lecithin Capsules); and

2.Surgical (Wound care and healing) – Beifuji series (Beifuji spray, Beifuji lyophilised powder and Beifuxin gel), T-Bactum® (anti-microbial oral care product), Carisolv® dental caries removal gel and 伊血安颗粒 (Yi Xue An Granules).

The sectoral turnover of Ophthalmology and Surgical is approximately 42.9% and 57.1% of the Group’s turnover, respectively. The combined turnover of the Group’s flagship biologics, Beifushu series and Beifuji series, the basic fibroblast growth factor (bFGF) based biologic drugs, represented about 83.3% of the Group’s total turnover, of which Beifushu series and Beifuji series accounted for 27.1% and 56.2% of the Group’s turnover, respectively. The remaining 16.7% of the Group’s turnover is largely contributed from sales of Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Xalatan® Eye Drops, Xalacom® Eye Drops, 适丽顺® (Iodized Lecithin Capsules), T-Bactum® and 伊血安颗粒 (Yi Xue An Granules), collectively.

It is noted that to further strengthen pipeline and in-house R&D capability, the total expenditures (inclusive of acquired intangible assets) incurred in R&D for the year ended 31 December 2020 were approximately HK$214.8 million (2019: approximately HK$164.9 million), representing 22.0% (2019: 12.9%) of the turnover, of which approximately HK$206.2 million (2019: approximately HK$161.5 million) were capitalised.

During the year under review, the Group achieved after-tax profit of approximately HK$218.9 million as compared to approximately HK$302.5 million in 2019, representing a decrease of 27.6% which was attributed to the aforementioned impact of COVID-19.

As at 31 December 2020, the Group had cash and cash equivalents of approximately HK$599.8 million (31 December 2019: approximately HK$473.3 million).

To reward our valued shareholders, the Board is pleased to propose a final dividend of HK$0.05 (2019: HK$0.05) per ordinary share to be approved at the upcoming annual general meeting of the Company.

Significant Business Development Activities

The Group is committed to pragmatically investing in new products and technologies to strengthen the Group’s product and research and development (“R&D”) pipeline as near to mid-term growth driver in ophthalmology and long-term plan for new therapeutics in oncology. During the year under review, investments in ophthalmic products and licensing of a molecule for use in oncology are outlined as follows:

Investment in Ophthalmology

On 4 June 2020, the Group entered into a framework agreement with 西藏林芝百盛药业有限公司 (Tibet Linzhi Parkson Pharmaceutical Co., Ltd.) (“Parkson”) in relation to the possible acquisition of all intellectual property rights relating to all technologies and process of product R&D and production of 适丽顺® (Iodized Lecithin Capsules) and other medicinal products in different forms in which iodized lecithin serves as an active pharmaceutical ingredient.

On 15 October 2020, the Group entered into a co-development and exclusive license agreement (the “Co-Development License Agreement”) with Shanghai Henlius Biotech, Inc (“Henlius”). Pursuant to the Co-Development License Agreement, the Group has agreed to fund up to US$24.0 million i.e. 80% of the development costs of a pharmaceutical product that contains an anti-vascular endothelial growth factor (“anti-VEGF”) as a drug substance (the “Licensed Product”), which is intended for the treatment of exudative (wet) age-related macular degeneration (“wet-AMD”), being a bevacizumab biosimilar candidate and to make other payments and royalties in accordance with the terms of the Co-Development License Agreement. In return, the Group has obtained an exclusive license for the regulatory development, manufacture and commercialisation of the Licensed Product worldwide, subject to commercial sales milestone payment and royalties levied on net sales of the Licensed Product payable to Henlius. In the event that the Group grants a sub-license to a third party for commercialisation of the Licensed Product, the Group will share 20% of the relevant sub-licensing revenue with Henlius unless otherwise adjusted in accordance with the terms of the Co-Development License Agreement.

The filing by Henlius of clinical trial for recombinant anti-VEGF humanised monoclonal antibody ophthalmic injection HLX04-O for the treatment of wet-AMD has been approved by Therapeutic Goods Administration, Australia, and the phase 3 clinical trial is permitted to commence in Australia (CTN No. CT-2020-CTN-04843-1). Accordingly, a phase 3 clinical study with respect to the Licensed Product is intended and expected to be initiated in Australia in the near future.

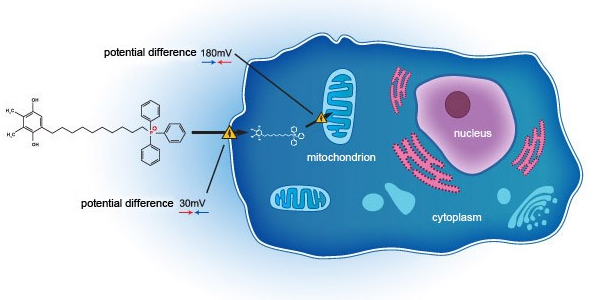

Apart from the above investments, in 2018, the Group entered into a co-development agreement with Mitotech S.A. and Mitotech LLC for the U.S.FDA phase 3 clinical trial of an ophthalmic solution containing SkQ1 for dry eye disease. As disclosed in the announcement of the Group dated 24 February 2021, positive outcome was achieved during second phase 3 clinical trial (VISTA-2). The clinical trial study repeated statistically significant positive results on key predefined secondary endpoint (Central Corneal Fluorescein Staining). The board of directors of the Group (the “Board”) is enthusiastic about the read-out of clearing of central staining of the cornea (defined as zero staining in central cornea), which reveals the potential of SkQ1 in addressing oxidative stress in dry eye diseases, and is looking forward to seeing the results of the third phase 3 clinical trial (VISTA-3) on the overall regulatory pathway towards the new drug application submission with the US FDA targeted by Mitotech S.A. to be made in the year of 2022 to 2023.

Investment in Oncology

On 28 August 2020, the Group entered into an intellectual property license agreement (the “IP License Agreement”) with 广州康睿生物医药科技股份有限公司 (Guangzhou Kangrui Biological Pharmaceutical Technology Co., Ltd.) (“Kangrui”). Pursuant to the IP License Agreement, Kangrui granted to the Group an exclusive license to develop, manufacture, use or otherwise commercialise any therapeutic products incorporating the molecule initially developed by Kangrui for use in oncology (the “Molecule”).

In line with the Group’s strategic development plans in oncology, the IP License Agreement presents a good opportunity for the Group to evaluate the suitability of developing and commercialising the Molecule in the field of therapeutic use and/or therapies in oncology.

Market Development

Over the years, the Group has been relentlessly investing in establishing and strengthening its market access capability. As at 31 December 2020, the Group maintains a network of 43 regional sales offices in the PRC and a total number of about 1,290 sales and marketing representatives, out of which approximately 38% are on contract basis or from appointed agents.

During the year under review, the Group’s therapeutic products are being prescribed in more than 9,000 hospitals and medical providers, coupled with approximately 2,000 pharmaceutical stores, which are mainly located in the major cities, provinces and county cities in the PRC.

For achieving a sustainable traction on growth for currently marketed products as well as for near-term to mid-term new products being commercialised, the Group initiated investments to improve its competitiveness and widen its customer base under the following plans:

- Investing in clinical observation programmes for affirming additional clinical indications of its commercialised products;

- Reaching out to market in lower-tier cities;

- Cultivating pharmaceutical stores, where possible, as complementary sales channel; and

- Building on-line platform for medical consultation and e-prescription for patients with chronic diseases under its healthtech initiative.

During the year under review, the Group has initiated its market access expansion to Southeast Asian countries by setting up a base in Singapore.

Research and Development

During the year under review, the Group renewed its R&D ’s vision, dedicated to science and innovation, with a mission to develop therapeutics that would meet unmet clinical and/or commercial needs. The Group concurrently kick started a 5-year (2021 to 2025) R&D’s development plan to further strengthen its R&D capability and its position in ophthalmology.

As at 31 December 2020, there are 15 R&D programmes in the pre-clinical to clinical stage, out of which 4 ophthalmology programmes are in Investigational New Drug (“IND”)/ Clinical/ New Drug Application (“NDA”) stage. The 4 ophthalmology programmes listed below are targeted as mid-term growth driver.

- EB11-18136P: SkQ1 eye drops, second phase 3 clinical trial (US FDA) topline data released on 24 February 2021

- EB11-15120P: Azithromycin eye drops, pending phase 3 clinical trial results (National Medical Products Administration (“NMPA”) in the PRC)

- EB11-13108P: Moxifloxacin eye drops, NDA stage (NMPA in the PRC)

- EB12-20145P: Bevacizumab for wet-AMD, IND ready stage (global, US FDA, European Medicines Agency and NMPA in the PRC)

During the year under review, the following programmes were completed with good success. The completed programmes would strengthen the currently marketed product portfolio, served as near- term growth driver.

- EB12-05100P (ophthalmology): Beifushu (FGF2) unit-dose eye drops, entered commercial stage (in the PRC)

- EB12-17133Z (dermatology): Beifuji (FGF2) increased dosage for external use, entered commercial stage (in the PRC)

- EB23-18235Y (stomatology): T-Bactum® (anti-microbial oral care product), entered commercial stage (in the PRC)

To advance our pursuits of new therapeutics programme involving antibodies that, in particular, target in oncology and ophthalmology, a wholly owned subsidiary, EssexBio Therapeutics Inc. (“EssexBio USA”), has been incorporated in the United States in March 2020. EssexBio USA is set up as the Group’s R&D centre and clinical trial management of the Group’s products in the United States. Being in the United States, EssexBio USA will continue to position the Group with better visibility for in and out licensing potential of technologies and products.

COVID-19 remains a major concern in 2021 globally. We continue to monitor the situation and will take appropriate actions to overcome any difficulty in this unforeseen circumstance. Barring the unforeseen circumstance, the Group remains focus on executing its plans and delivering progressive results.

~ End ~

About Essex

Essex Bio-Technology Limited is a bio-pharmaceutical company that develops, manufactures and commercialises genetically engineered therapeutic rb-bFGF (FGF-2), having six commercialised biologics marketed in China since 1998. The products of the Company are principally prescribed for the treatment of wounds healing and diseases in Ophthalmology and Dermatology, which are marketed and sold through approximately 9,000 hospitals and managed directly by its 43 regional sales offices in China. Leveraging on its in-house R&D platform in growth factor and antibody, the Company maintains a pipeline of projects in various clinical stages, covering a wide range of fields and indications.

粤公网安备 44049102496184号

粤公网安备 44049102496184号