COMPANY NEWS

Essex Bio-Technology Reports First Half 2021 Financial Results

2021.08.12

Download

· Net profit Grew 229.7% to HK$162.2 million with

· Turnover Increased 127.7% to HK$ 737.4 million

Hong Kong, 12 Aug 2021

Essex Bio-Technology Ltd (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the interim results for the six months ended 30 June 2021.

Financial Performance

For the six months ended 30 June 2021, the Group achieved a consolidated turnover of approximately HK$737.4 million, an increase of 127.7% as compared to the same period last year. In tandem with the increase in turnover, the Group achieved a net profit of approximately HK$162.2 million as compared to approximately HK$49.2 million for the corresponding period last year, representing an increase of 229.7%.

The turnover of HK$ 737.4 million and net profit of HK$162.2 million representing an increase of 26.8% and 25.2%, respectively, as compared to the same period of 2019, indicating a strong recovery to pre-COVID-19 operating level.

The Group’s turnover is primarily made up from the segments of Ophthalmology and Surgical (wound care and healing). The core products that are of current growth driver under each segment are:

· Turnover Increased 127.7% to HK$ 737.4 million

Hong Kong, 12 Aug 2021

Essex Bio-Technology Ltd (“Essex” or the “Group”, Stock Code: 1061.HK) today announced the interim results for the six months ended 30 June 2021.

Financial Performance

For the six months ended 30 June 2021, the Group achieved a consolidated turnover of approximately HK$737.4 million, an increase of 127.7% as compared to the same period last year. In tandem with the increase in turnover, the Group achieved a net profit of approximately HK$162.2 million as compared to approximately HK$49.2 million for the corresponding period last year, representing an increase of 229.7%.

The turnover of HK$ 737.4 million and net profit of HK$162.2 million representing an increase of 26.8% and 25.2%, respectively, as compared to the same period of 2019, indicating a strong recovery to pre-COVID-19 operating level.

The Group’s turnover is primarily made up from the segments of Ophthalmology and Surgical (wound care and healing). The core products that are of current growth driver under each segment are:

- Ophthalmology – Beifushu series (Beifushu eye drops, Beifushu eye gel and Beifushu unit-dose eye drops), Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Xa-latan® Eye Drops, Xalacom® Eye Drops and 适丽顺® (Iodized Lecithin Capsules); and

- Surgical (Wound care and healing) – Beifuji series (Beifuji spray, Beifuji lyophilised powder and Beifuxin gel), T-Bactum® (anti-microbial oral care product), Carisolv® dental caries removal gel and 伊血安颗粒 (Yi Xue An Granules).

The sectoral turnovers of Ophthalmology and Surgical account to approximately 39.9% and 60.1% of the Group’s turnover, respectively. The combined turnover of the Group’s flagship biologics, Beifushu series and Beifuji series, the bFGF based biologic drugs, represented about 86.4% of the Group’s total turnover, of which Beifushu series and Beifuji series respectively account to 27.0% and 59.4% of the Group’s turnover. The remaining 13.6% of the Group’s turnover is largely contributed by sales of Tobramycin Eye Drops, Levofloxacin Eye Drops, Sodium Hyaluronate Eye Drops, Xalatan® Eye Drops, Xalacom® Eye Drops, 适丽顺® (Iodized Lecithin Capsules), T-Bactum® and 伊血安颗粒 (Yi Xue An Granules) collectively.

The turnover from the Group’s Ophthalmology products achieved approximately HK$294.0 million, representing an increase of 101.4% as compared to the same period last year. Surgical products recorded a total turnover of approximately HK$443.4 million, an increase of 149.4% as compared to the same period last year. The increase was attributable to the aforementioned resumption of clinical operations in hospitals to normalcy in the PRC.

The total R&D expenditures (inclusive of acquired intangible assets) as of 30 June 2021 for the period under review were approximately HK$85.9 million (approximately HK$47.7 million for the same period in 2020) among which approximately HK$74.8 million (approximately HK$44.7 million for the same period in 2020) were capitalised. The increase is in-line with the Group’s plan in strengthening its R&D pipelines and capability.

The Group had cash and cash equivalents of approximately HK$657.8 million as of 30 June 2021 (31 December 2020: approximately HK$599.8 million).

Significant Business Development Activities

The Group has been committed to pragmatically investing in new products and technologies to strengthen own product and R&D pipelines. Apart from empowering near to mid-term growth drivers in ophthalmology, the Group has consistently proceeded with new therapeutics in oncology to sustain long term development. Major investments in ophthalmic products are outlined as follows:

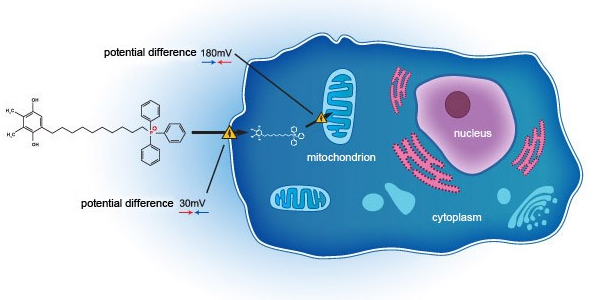

In 2018, the Group entered into a co-development agreement with Mitotech S.A. (“Mitotech”) and Mitotech LLC for the the U.S. FDA phase 3 clinical trial of an ophthalmic solution containing SkQ1 for dry eye disease. As disclosed in the announcement of the Company dated 24 February 2021, positive outcome was achieved during second phase 3 clinical trial (VISTA-2). The clinical trial study repeated statistically significant positive results on key predefined secondary end-point (Central Corneal Fluorescein Staining). The board of directors of the Group (the “Board”) is enthusiastic about the read-out of clearing of central staining of the cornea (defined as zero staining in central cornea), which reveals the potential of SkQ1 in addressing oxidative stress in dry eye diseases, and is looking forward to seeing the results of the third phase 3 clinical trial (VISTA-3) on the overall regulatory pathway towards the new drug application submission with the US FDA targeted by Mitotech to be made in the year of 2022 to 2023.

According to Frost & Sullivan, the estimated number of patients of moderate-to-severe dry eye disease is over 117 million in the PRC in 2019. It is expected that the size of the potential market of the SkQ1 Product will be significant.

In 2020, the Group entered into a co-development and exclusive license agreement with Shanghai Henlius Biotech, Inc. (“Henlius”) to co-develop a pharmaceutical product that contains an anti-vascular endothelial growth factor (“anti-VEGF”) as a drug substance (the “Anti-VEGF Licensed Product”), which is intended for the treatment of exudative (wet) age-related macular degeneration (“wet-AMD”). As at the date of this report, the recombinant anti-VEGF humanised monoclonal antibody injection EB12-20145P(HLX04-O) for the treatment of wet-AMD has been approved to start the phase 3 clinical trial in Australia, the United States, Singapore and European Union countries such as Hungary, Spain and Latvia. Meanwhile, in the PRC the first patient has been dosed in a phase 1 clinical study for EB12-20145P(HLX04-O) for the treatment of wet-AMD.

The Anti-VEGF licensed product can be used for treating wet-AMD, diabetic macular edema, macular edema caused by retinal vein occlusion and myopic choroidal neovascularisation. According to Frost & Sullivan, the estimated number of patients of these 4 categories of disease is over 15.5 million in the PRC in 2019. Assuming each patient applies 4 doses in the first year of treatment and 2 to 3 doses in subsequent years, the potential market size of the Anti-VEGF licensed product will be significant.

On 9 June 2021, the Group entered into a product interests transfer agreement with Tibet Linzhi Parkson Pharmaceutical Co., Ltd. (“Parkson Pharmaceutical”) in relation to the acquisition of intellectual property rights relating to all technologies and process of product R&D and production of 适丽顺® (Iodized Lecithin Capsules) and other medicinal products in different forms in which iodized lecithin serves as an active pharmaceutical ingredient. The consideration of the acquisition is RMB97.0 million (equivalent to approximately HK$117.6 million) pursuant to the Product Interests Transfer Agreement. The acquisition will enable the Group to strengthen the ophthalmology business.

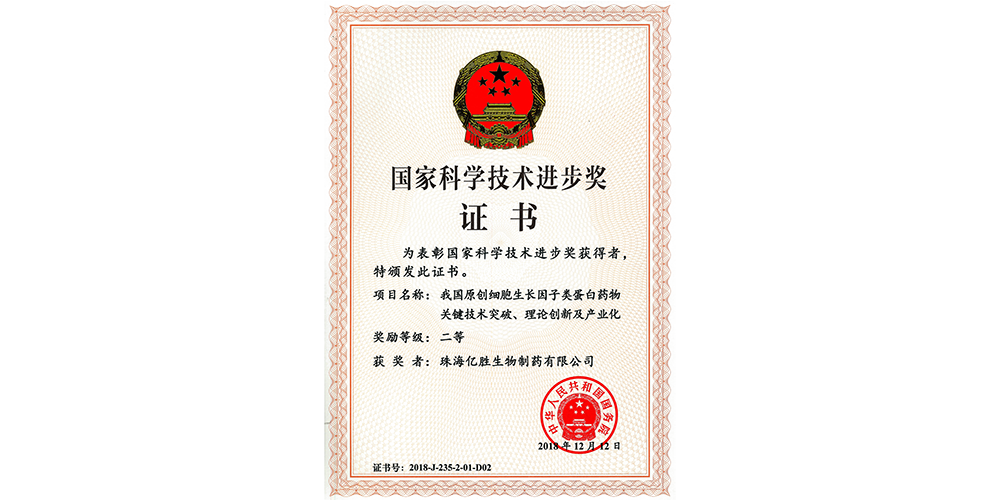

Honours and Awards Obtained In 1H 2021

- Zhuhai Essex Bio-Pharmaceutical Company Limited, a wholly-owned subsidiary of the Company, was listed on “2020 top 100 chemical pharmaceutical companies in the PRC”.

- The Group’s Beifushu was awarded as one of the Chinese reputable medicine brands in three consecutive years.

Market Development

Over the years, the Group has been relentlessly investing in establishing and strengthening its market access capability. As at 30 June 2021, the Group maintains a network of 43 regional sales offices in the PRC and a total number of about 1,280 sales and marketing representatives.

During the period under review, the Group’s therapeutic products are being prescribed in more than 9,760 hospitals and medical providers, coupled with approximately 2,100 pharmaceutical stores, which are widely located in the major cities, provinces and county cities in the PRC.

For achieving a sustainable traction on growth for currently marketed products as well as for near-term to mid-term new products being commercialised, the Group has initiated investments to improve its competitiveness and widen its customer base under the following plans:

- Investing in clinical observation programmes for affirming additional clinical indications of its commercialised products;

- Reaching out to market in lower-tier cities;

- Cultivating pharmaceutical stores, where possible, as complementary sales channel; and

- Building on-line platform for medical consultation and e-prescription for patients with chronic diseases under its healthtech initiative.

Research and Development

The Group renewed its R&D’s vision in 2020, emphasising the dedication to science and innovation, with a mission to develop therapeutics that would meet unmet clinical and/or commercial needs. The Group concurrently kick-started a 5-year (2021 to 2025) R&D’s development plan to further strengthen its R&D capability and its position in ophthalmology.

During the period under review, the Group has obtained an approval for the registration and commercialisation of the preservative-free unit-dose Moxifloxacin Hydrochloride Eye Drops in the PRC.

As of 30 June 2021, there are 14 R&D programmes in the pre-clinical to clinical stage, out of which 3 ophthalmology programmes are in Investigational New Drug (“IND”)/Clinical stage. The 3 ophthalmology programmes listed below are targeted as mid-term growth driver.

- EB11-18136P: SkQ1 eye drops, second phase 3 clinical trial (US FDA) VISTA-2 topline data released on 24 February 2021

- EB11-15120P: Azithromycin eye drops, ongoing review by external key opinion leaders (National Medical Products Administration (“NMPA”) in the PRC)

- EB12-20145P: Bevacizumab intravitreal injection for wet-AMD, phase I clinical trial (global, US FDA, European Medicines Agency and NMPA in the PRC)

The Group currently has diversified its R&D resources to multiple research sites in Zhuhai (PRC), Boston (US), London (UK) and Singapore which supports not only our pursuit for new therapeutics but also our acquisition of global talent.

To further reward our valued shareholders, the Board has resolved on 12 August 2021 to declare an interim dividend of HK$0.04 (For the six months ended 30 June 2020: Nil) per ordinary share for the six months ended 30 June 2021.

粤公网安备 44049102496184号

粤公网安备 44049102496184号